Welcome to Guard The Constitution Project!

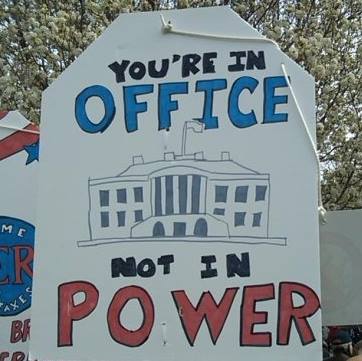

“…The people are the only legitimate fountain of power”

– Federalist 49, Madison

Guard The Constitution was founded to put the “We” back in “We The People.” Elected officials work for us. Let’s flip the script to stop asking permission to exercise our rights. Follow us to learn about a proven system that makes elected officials follow us, not the monied taskmasters.

Education, information, and ultimately, truth, are essential to the patriot. However, an effective and proven process for patriots to unite in focused, powerful, and effective action is key also.

As we work to expand our efforts to guard the Constitution, this website will be more fully in the coming weeks. To be kept informed as we add content, format, and begin taking action, please let us know how to reach you.

If you provide your email, we will be sure you are the first group notified of our next step. You will also be the first to see our patent pending program which will be sure to rapidly grow Guard The Constitution into one of the largest citizenship education and activation websites.

Contact us now:

https://guardtheconstitution.com/contact

Guard The Constitution works to make the Constitution understandable, actionable, supreme

Our Problem

Our Solution